Cheap auto insurance quotes in Florida are crucial for drivers seeking cost-effective coverage. This comprehensive guide explores the factors influencing rates, comparing different policies and providers, and offering practical tips for saving money. We’ll delve into strategies for securing competitive quotes and highlight the importance of understanding your specific needs and Florida’s unique insurance landscape.

Florida’s insurance market presents a diverse array of options. Understanding the different types of coverage, the impact of driving history, and the various discounts available can significantly impact your premium. We’ll also cover the process of obtaining competitive quotes, from utilizing online comparison tools to negotiating with providers.

Understanding Florida Auto Insurance: Cheap Auto Insurance Quotes In Florida

Getting affordable auto insurance in Florida requires understanding the factors that influence premiums. Florida’s sunny climate and relatively high rate of accidents can impact the cost of coverage. Navigating the different coverage types and their associated costs is crucial for making informed decisions.Florida’s auto insurance landscape is shaped by various factors, including driving history, claims history, and the specific coverage options selected.

Understanding these elements empowers you to find the best possible balance between protection and affordability.

Factors Influencing Auto Insurance Premiums in Florida

Various elements play a role in determining the cost of your auto insurance in Florida. These factors are often interconnected and can significantly impact your premium. Demographic data, such as age and location, and driving history, including accidents and traffic violations, can influence rates.

- Driving Record: Accidents and violations, such as speeding tickets or DUIs, directly impact insurance rates. A clean driving record generally leads to lower premiums. For instance, a driver with multiple speeding tickets will likely face higher premiums compared to a driver with no violations.

- Vehicle Type and Value: The type of vehicle you drive and its value can influence the premium. Sports cars or high-performance vehicles often have higher premiums than standard models due to their perceived risk. The value of the vehicle plays a role in determining the amount of coverage needed for comprehensive and collision insurance.

- Location and Demographics: The specific area in Florida where you live and drive can affect premiums. High-accident areas often have higher premiums. Age and gender can also be factors, though these have less direct impact than driving history.

- Coverage Level: Choosing comprehensive, collision, and liability coverage levels impacts premiums. Higher coverage levels typically result in higher premiums. For instance, higher liability limits for bodily injury and property damage will increase the cost of your insurance.

Types of Auto Insurance Coverage Available in Florida

Florida mandates specific minimum coverage levels for liability insurance. However, you can enhance your protection with additional coverages.

- Liability Coverage: This protects you from financial responsibility if you cause an accident. Florida requires liability coverage to be maintained. It’s essential for covering injuries or damages caused to other drivers or their property.

- Collision Coverage: This coverage pays for damage to your vehicle regardless of who is at fault in an accident. This protects you in the event you cause an accident or are involved in one.

- Comprehensive Coverage: This coverage pays for damage to your vehicle from non-collision incidents, such as vandalism, theft, or weather events. This protection is beneficial for protecting against unforeseen events.

- Uninsured/Underinsured Motorist Coverage: This coverage pays for your injuries or vehicle damages if you are involved in an accident with an uninsured or underinsured driver. Florida law requires this coverage for drivers in Florida.

Comparison of Coverage Levels in Florida, Cheap auto insurance quotes in florida

Different coverage levels result in different premiums. Comparing various coverage options helps in selecting the most suitable plan. Understanding the trade-offs between coverage and cost is critical.

| Coverage Type | Description | Typical Cost (Example) |

|---|---|---|

| Liability Only | Minimum coverage required by Florida law. | $100-$500 per year |

| Liability + Collision + Comprehensive | Full coverage for both damage to your vehicle and for injuries or damages to others. | $1,000-$3,000+ per year |

| Liability + Collision + Comprehensive + Uninsured/Underinsured Motorist | Highest level of protection, including coverage for uninsured drivers. | $1,500-$4,000+ per year |

Driving History and Claims History in Determining Auto Insurance Rates

Your driving record and claims history significantly affect your auto insurance rates in Florida.

- Driving History: Accidents, violations, and claims history influence premiums. A clean driving record with no accidents or violations usually results in lower rates. A driver with a history of accidents or violations will face significantly higher premiums.

- Claims History: Previous claims made on your policy can affect your future premiums. A history of frequent or substantial claims often results in higher premiums. For instance, drivers who have filed claims for substantial damages or frequent accidents may face higher rates.

Florida Driver’s License and Insurance Rates

Obtaining a Florida driver’s license involves meeting certain requirements. This process affects your insurance rates.

- Licensing Process: The Florida Department of Highway Safety and Motor Vehicles (FLHSMV) oversees the driver’s licensing process. Meeting age and other requirements is essential.

- Impact on Rates: A valid Florida driver’s license is a necessity. Insurance companies consider this a crucial factor in assessing risk. A driver without a valid license faces higher insurance rates.

Minimum Coverage Limits Comparison

Comparing minimum coverage requirements across different states helps in understanding the relative risks and responsibilities associated with auto insurance.

| State | Minimum Liability Coverage (Bodily Injury) | Minimum Liability Coverage (Property Damage) |

|---|---|---|

| Florida | $10,000 per person, $20,000 per accident | $10,000 |

| Other States (Examples) | (Vary significantly) | (Vary significantly) |

Finding Cheap Quotes

Source: cloudinary.com

Securing affordable auto insurance in Florida requires proactive research and comparison. Understanding the various avenues for obtaining quotes, along with the factors influencing pricing, is crucial. This approach ensures you get the best possible deal tailored to your specific needs and driving record.Finding multiple quotes is key to securing the most competitive rate. Different insurance providers assess risk differently, leading to varied premiums.

Shopping around can yield significant savings. A comprehensive approach to price comparison will help you locate the best insurance option for your budget.

Strategies for Finding Multiple Quotes

Locating numerous quotes requires a strategic approach. Utilizing online comparison tools is one such method. These platforms gather data from multiple insurers, allowing for a rapid overview of various options. Directly contacting insurance providers is another strategy. Requesting quotes directly from companies allows you to clarify any specific coverage needs or requirements.

Benefits and Drawbacks of Online Comparison Tools

Online comparison tools offer the advantage of rapid quote comparisons from multiple providers. This significantly reduces the time and effort needed to gather various options. However, these tools may not always provide the most comprehensive coverage options. A direct approach with insurers can often provide customized coverage, a benefit that might not be available through online tools.

Types of Insurance Providers and Their Relative Costs

Florida’s insurance market comprises several types of providers, each with varying pricing structures. Nationwide companies generally have established pricing models, offering competitive rates, while regional companies often tailor their rates to local factors. Smaller, local agencies may provide personalized service, but their rates might vary.

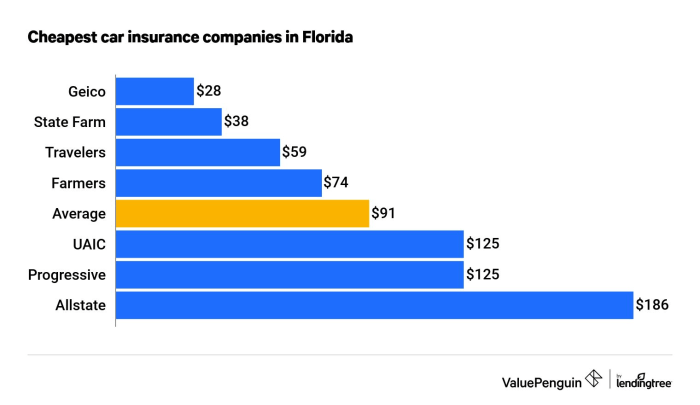

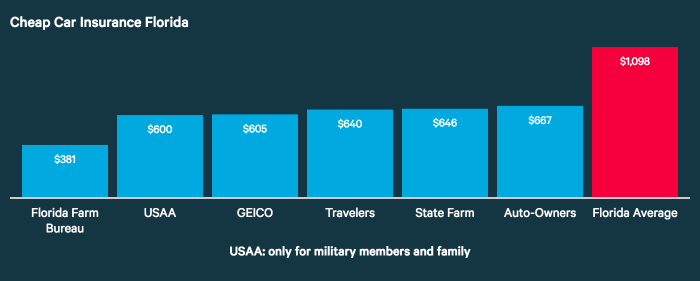

Comparison of Prices from Various Providers

Numerous providers offer competitive rates in Florida. Factors like driving history, vehicle type, and coverage selections impact the final premium. Compare quotes from several providers to identify the most cost-effective option. For example, Geico, State Farm, and Progressive are well-known companies often associated with competitive rates. Researching reviews and financial stability of providers is also advisable.

Bundling Auto Insurance with Other Products

Bundling auto insurance with other insurance products, like homeowners or renters insurance, often yields discounted rates. This approach can save money and consolidate your insurance needs under a single provider. The combined discount offered can be substantial, and some providers offer greater discounts for multi-product bundling.

Using Online Search Filters for Lowest Prices

Online comparison tools allow for filtering options based on specific needs and requirements. For instance, filtering by coverage type, deductibles, and policy add-ons can help pinpoint insurers offering the lowest prices. Utilize these filters to streamline the search and focus on the most relevant options.

Comparison of Online Comparison Websites

| Website | Features | Typical Price Range |

|---|---|---|

| Insurify | Comprehensive comparison, user-friendly interface, various filters | $800-$1500 annually |

| Policygenius | In-depth coverage options, personalized recommendations, detailed policy breakdowns | $750-$1400 annually |

| QuoteWizard | Wide selection of insurers, fast quote generation, detailed comparison tables | $900-$1600 annually |

Note: Price ranges are estimates and can vary based on individual circumstances.

Factors Affecting Quote Prices

Source: cloudinary.com

Securing affordable auto insurance in Florida hinges on understanding the various factors that influence premiums. These factors range from the characteristics of your vehicle to your driving record and even your creditworthiness. Knowing these influences empowers you to make informed decisions to minimize your insurance costs.Several key elements significantly impact your auto insurance premium in Florida. Understanding these factors allows you to proactively manage your insurance costs.

By making conscious choices in areas like vehicle selection and driving habits, you can potentially secure more favorable rates.

Vehicle Type Impact

Vehicle type plays a crucial role in determining insurance premiums. Higher-performance vehicles, often equipped with powerful engines and advanced safety features, tend to have higher insurance premiums compared to standard models. This is due to the increased risk associated with potential damages and liabilities, especially in accidents. Conversely, smaller, economical vehicles typically have lower premiums, reflecting their lower risk profile.

For instance, a sports car, known for its potential for high-speed accidents, might attract a higher premium than a compact sedan.

Age and Gender Influence

Age and gender are factors frequently considered in determining auto insurance rates. Younger drivers, typically those in their teens and twenties, often face higher premiums compared to older drivers. This reflects the statistically higher accident risk associated with inexperience. Similarly, insurance companies often assess gender as a factor, though the impact is less significant in Florida. Insurance providers rely on statistical data to predict accident likelihood and the frequency of claims.

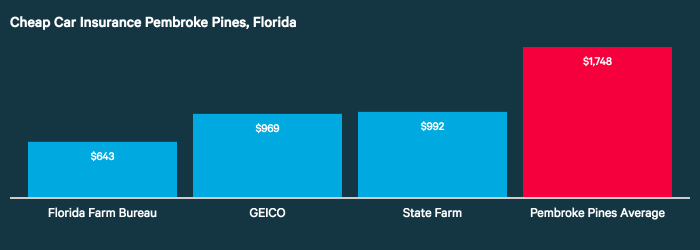

Location Impact

The location within Florida where you reside impacts insurance premiums. Areas with higher rates of accidents or theft tend to have correspondingly higher insurance rates. Factors such as proximity to major highways, crime rates, and population density influence these rates. For example, areas with higher concentrations of high-risk drivers or areas with a history of accidents might experience increased insurance premiums.

Driving Habits Influence

Driving habits significantly affect your insurance rates. Drivers with a history of accidents or traffic violations typically face higher premiums. Insurance companies assess driving habits through factors like accident records and traffic violations, which reflect the driver’s risk profile. A driver with a clean driving record and responsible habits often receives favorable rates, reflecting their lower likelihood of accidents.

Credit Score Impact

Credit score, a measure of financial responsibility, is increasingly used as a factor in determining auto insurance premiums in Florida. Insurance companies correlate credit scores with risk assessment, and a lower credit score often translates to a higher insurance premium. This is because a lower credit score might be indicative of a higher risk of non-payment or a lack of financial responsibility.

For example, a driver with a consistently low credit score may face a higher premium.

Available Discounts

| Discount Type | Description |

|---|---|

| Safe Driver Discount | This discount rewards drivers with clean driving records and a history of responsible driving habits. |

| Multi-Policy Discount | Insuring multiple vehicles or other insurance products with the same company can often lead to discounts. |

| Defensive Driving Courses | Completing defensive driving courses demonstrates a commitment to safe driving practices, potentially earning a discount. |

| Good Student Discount | Students with good academic records may qualify for this discount, reflecting a commitment to responsibility. |

| Bundling Discount | Combining auto insurance with other insurance products, like homeowners insurance, can result in bundled discounts. |

Insurance providers offer a variety of discounts to incentivize safe driving and responsible financial behavior. These discounts can significantly reduce insurance costs. For instance, a safe driver discount can save substantial amounts, while bundled discounts can offer further savings. Understanding these discounts can help you find more affordable insurance options.

Comparison of Policies

Source: cloudinary.com

Florida offers a variety of auto insurance policy options, each with varying levels of coverage and associated costs. Understanding the different types and their nuances is crucial for selecting a policy that best meets your needs and financial situation. Careful consideration of coverage options, policy limitations, and your driving habits is key to securing the most suitable insurance for your vehicle.Selecting the right auto insurance policy involves a careful balancing act between cost and adequate protection.

This comparison Artikels the different policy types, coverage options, and their implications, enabling informed decisions about your vehicle’s insurance needs.

Types of Auto Insurance Policies in Florida

Different policy types provide varying levels of protection and financial responsibility. Understanding the distinctions between these policies is essential for making the right choice.

| Policy Type | Description | Coverage | Typical Cost |

|---|---|---|---|

| Liability-Only | Covers damages you cause to other people or their property. | Bodily injury liability, property damage liability | Lowest |

| Collision | Covers damage to your vehicle regardless of who is at fault. | Damage to your vehicle in a collision | Higher than liability-only |

| Comprehensive | Covers damage to your vehicle from events other than collisions, like theft, vandalism, or weather damage. | Damage to your vehicle from non-collision events | Higher than liability-only and collision |

| Uninsured/Underinsured Motorist | Covers damages if you are involved in an accident with an at-fault driver who does not have insurance or has insufficient coverage. | Bodily injury and property damage from uninsured/underinsured drivers | Higher than liability-only |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for you and your passengers in an accident, regardless of fault. | Medical expenses, lost wages, and other related costs | Higher than liability-only and can vary significantly |

Coverage Options for Different Vehicle Types

The cost of insurance can differ based on the type of vehicle you own. Factors such as vehicle value, make, model, and year of manufacture influence the premium.

- Classic or antique vehicles: Insurance premiums for classic or antique vehicles may be higher due to their unique value and potential for damage or theft. Specific policies often address their unique needs.

- Luxury vehicles: Luxury vehicles often come with higher premiums due to their higher value and potentially higher risk of theft or damage.

- High-performance vehicles: High-performance vehicles, like sports cars or trucks, can also have higher premiums, as they may be involved in more high-speed accidents or attract more attention from potential thieves.

- Motorcycles: Motorcycle insurance often comes with higher premiums than standard car insurance, due to the higher risk of accidents and lower safety features.

Liability-Only vs. Comprehensive Coverage

Liability-only coverage provides minimal protection, covering only damages you cause to others. Comprehensive coverage offers broader protection, covering a wider range of potential damages to your vehicle.

Liability-only coverage is typically the most affordable, but it offers the least protection for your vehicle. Comprehensive coverage provides more comprehensive protection and typically comes with a higher premium.

Selecting Appropriate Coverage in Florida

Several factors influence the selection of appropriate coverage for a vehicle in Florida.

- Vehicle Value: The value of your vehicle significantly impacts the cost and coverage required.

- Driving Habits: Driving history, such as accidents or traffic violations, can affect your premium.

- Desired Coverage Levels: Choosing the right level of coverage involves balancing cost and protection.

- Financial Situation: Your financial situation should also influence your choice of coverage.

Policy Limitations in Florida

Florida auto insurance policies have certain limitations.

- Deductibles: Deductibles are amounts you pay out-of-pocket before insurance coverage kicks in.

- Policy Exclusions: Policies often exclude certain types of damages or circumstances.

- Coverage Limits: Policy limits set the maximum amount the insurer will pay for a covered claim.

Illustrative Examples

Source: imgix.net

Finding the right auto insurance in Florida can feel like navigating a maze. Understanding how various factors influence your quote is key to getting the best deal. This section provides real-world examples to illustrate these concepts.

Impact of Driving Record on Premiums

A poor driving record significantly impacts auto insurance premiums in Florida. Consider a 25-year-old named Sarah, who lives in Jacksonville. She had two speeding tickets in the last two years. This resulted in a substantial increase in her insurance premium. Without the tickets, her premium would have been approximately $100 lower.

Insurance companies use driving records to assess risk. A clean record generally translates to lower premiums. Conversely, violations like accidents, speeding, or DUIs lead to higher premiums.

Bundling Discounts in Florida

Bundling your insurance policies can lead to substantial savings. For instance, consider a family named the Smiths in Tampa. They already had homeowners insurance with the same provider. When they bundled their auto insurance with their homeowners insurance, their monthly auto insurance payment was reduced by 15%. This is a common practice that many insurance providers offer to incentivize customers to consolidate their insurance needs.

How Online Comparison Tools Can Save Money

Using online comparison tools can lead to substantial savings. A young professional named David in Orlando wanted to compare auto insurance quotes. He used a reputable comparison website and discovered that his current provider was charging him 20% more than another provider. By switching companies, he saved over $200 annually. These tools are particularly valuable for comparing policies from multiple providers to find the most competitive rates.

Location’s Impact on Auto Insurance Costs

Location in Florida plays a significant role in auto insurance costs. A resident of Miami, for example, may pay a higher premium than someone living in a more rural area like Tallahassee. This is due to factors like traffic density, accident rates, and the cost of claims handling in a particular area. Miami’s higher cost of living and traffic density contribute to higher insurance premiums.

Illustrative Breakdown of Auto Insurance Costs in Florida

The infographic below illustrates the breakdown of average auto insurance costs in Florida, using a hypothetical example.

| Category | Percentage | Example (Annual Premium of $1,500) |

|---|---|---|

| Premiums | 65% | $975 |

| Vehicle Type/Age | 15% | $225 |

| Driver Profile | 10% | $150 |

| Coverage Options | 10% | $150 |

This hypothetical breakdown highlights the significant weight of premiums in overall costs. Factors such as vehicle type, driver characteristics, and chosen coverage levels also influence the overall expense.

Concluding Remarks

Source: cloudinary.com

In conclusion, securing cheap auto insurance quotes in Florida requires a proactive approach. By understanding the influencing factors, comparing policies, and implementing the saving strategies discussed, drivers can navigate the market effectively. This guide serves as a valuable resource for anyone seeking affordable and comprehensive auto insurance in the Sunshine State.

FAQ Guide

What are the typical minimum coverage limits in Florida?

Florida mandates minimum liability coverage, but higher limits are often recommended for better protection. The minimums vary depending on the type of coverage. Consult your state’s Department of Financial Services for detailed information.

How can I improve my driving record for better insurance rates?

Maintaining a clean driving record, avoiding traffic violations, and completing safe driving courses are key to obtaining favorable rates. Staying aware of local traffic laws and driving safely can prevent costly accidents and improve your driving record.

Do credit scores impact auto insurance premiums in Florida?

Yes, credit scores are a factor in determining your auto insurance premium in Florida. A higher credit score generally translates to a lower premium, reflecting your financial responsibility. Improving your credit score can directly influence your auto insurance rates.

Are there discounts available for Florida residents?

Yes, numerous discounts are available to Florida residents, such as discounts for safe driving, multi-policy bundling, and student status. Contact insurance providers directly to explore available discounts tailored to your specific circumstances.